Blog

Thoughts & insights across various investment topics & themes.

Market-Linked Debentures (MLDs): How They Work, Why They’re Popular, and the Risks Investors Must Understand

## What Is a Market-Linked Debenture (MLD)? A Market-Linked Debenture (MLD) is a **debt instrument** issued by a company, typically an NBFC, where the...

GIFT City (IFSC): How It Works, Who It’s For, and Where It Fits in Global Investing

## Background & What Is GIFT / IFSC? GIFT City was created to establish a globally competitive financial hub within India, comparable to centres such...

Specialized Investment Funds (SIFs): Structure, Taxation, Pros & Cons, Should you Invest?

Background of SIFs SEBI introduced the Specialized Investment Fund (SIF) concept in India to bridge the gap between: - Traditional Mutual Funds (MFs)...

How UAE Tax-residents can avoid paying capital gains tax on Indian Mutual Funds?

UAE does not levy capital gains tax on its tax residents. However, what about capital gains taxes charged by the Indian tax authorities, for investmen...

Why Past Performance Is a Poor Predictor of Future Returns

One of the most common mistakes investors make is relying too heavily on past performance when choosing funds. It’s understandable — return numbers ar...

Why Real Estate Is Often Riskier Than Equity — Contrary to Popular Belief

For most Indian investors, real estate continues to be perceived as a “safe” investment — a tangible asset you can see and touch, and one that offers...

Why We Strongly Recommend Equity Funds Over Direct Stock Investing

Investing in equities is one of the best ways to build long-term wealth. However, how you gain exposure to equities can make a huge difference in your...

Why Focusing on Short-Term Market Concerns Can Cost Investors

Investors often find themselves trapped in the cycle of paying too much attention to short-term negative news. This pattern of hesitation can delay th...

Lumpsum versus Staggering? What is the more optimal way to invest larger sums of money?

Investors sometimes have a larger-than normal amount of money that is available for investments (this could be due to an annual bonus, an asset sale,...

FM Churn and why this leads to us prefering Owner-Managed Boutique Investment Firms

Since 2015, the investments industry in India has seen a very sharp rise in some of the most senior fund managers (FMs) in the industry, leaving to se...

Arbitrage Funds: Why Post-tax Yields are Superior to Debt Funds?

Post the change in taxation on debt funds from 1-Apr-23 (returns will now be taxed at your income tax slab, as compared to more favourable capital gai...

The Best International Investment Options across Global Markets

Our International Investing platform provides investors with a large range of investment options, across global, regional & country-specific & themati...

Structured Products: Equity Market Linked Debentures

Equity Market Linked Debentures (a form of structured products), provide investors an ability to participate in the equity markets with differentated...

Taxation Structure of Different Investment Structures

The capital gains tax regime can be complex, with different rates & threshold period for different asset classes & investment structures. We provide b...

Why US Persons should consider investing in a PMS, instead of a MF or AIF (due to PFIC taxation)?

Taxation of global investments for US Persons can be complicated, especially in the case of pooled investment vehicles (such as Mutual Funds or Altern...

PMS vs MF: Longer-term Performance Comparison

One of the core premises of investor's preferring PMS's over MF's, is the ability for PMS's to manage more concentrated, higher risk-reward portfolios...

Venture Capital Funding - Understanding the different funding rounds

## Stages of Venture Funding Given the strong interest and enthusiasm around venture capital, it is crucial to understand the various stages of ventur...

Largecap vs Midcap vs Smallcap: Understanding their relative risk-return

Markets are cyclical in nature driven by economic and business cycles further exaggerated by the psychology/behaviour of the market participants. Whil...

Types of Life Insurance Plans

In this blog post, we compare the various types of life-insurance policies, along with our reasons for why we typically only recommend Term-Insurance...

Portfolio Optimisations for Corporate Treasuries

At IME Capital, we believe that there is a substantial scope for optimising the post-tax portfolio yields of corporate treasuries. - **Investment hori...

Gold as an Investment Class - Why we see it as a highly risky asset?

Many investors consider gold as a relatively low-risk and safe haven asset class, with certain advisors recommending investments in gold as a core-par...

Investing in International Assets - The Rationale & Recommended Routes

## Rationale for Investing in International Assets Having some part of your investment portfolio allocated to international assets, have very strong d...

Comparison & Review of Top Equity PMSs in India

Unlike Mutual Funds, where SEBI has come out with clear guidelines of % allocation towards large, mid & small-caps between different fund categories,...

MF AMC Reviews & Ratings

Mutual Fund selections at IME Capital are driven by our 3 stage fund-selection criteria, as detailed in our blog post - IME Mutual Fund Selection Meth...

The Importance of an Investment Mandate

## What is an investment mandate? Your investment mandate is a written document, that clearly spells out your **unique requirements,** that includes y...

Comparison & Review of Top Long-Short AIFs in India

## Understanding Long-Short Strategies ### Equity Funds vs Long-Short Funds Most equity funds are long-only - they buy stocks and benefit when stock p...

Alternative Investment Funds (AIF) Overview

Alternative Investment Funds (AIF's) are investment funds that are targeted at more sophisticated & wealthy investors (require a minimum investment of...

Small Saving Schemes

Small saving schemes are government-administered savings products. These schemes are backed by the government which ensures the safety of the capital....

The Risks of Investing in High-Yielding Debt

High-yield bonds (popularly known as ""junk bonds"") are corporate debt securities that pay higher interest rates because of the low credit rating of...

Mutual Fund Taxation

A mutual fund is structured as a pass-through vehicle. The fund, in the form of a trust, itself is exempted from any taxation. Therefore, all the tax...

PMS & AIF Taxation

## Overview ## PMS Taxation PMS is a pass-through vehicle from a tax perspective. Since under a PMS, investments are held directly in the investor's n...

Mutual Funds vs. PMS vs. AIF

Mutual Funds, Portfolio Management Services (PMS) and Alternative Investment Funds (AIF) are all investment vehicles, where your equity or debt invest...

The 7 Main Benefits of Systematic Investment Plans (SIPs)

Systematic Investment Plans (or SIPs), are one of the most recommended ways of investing in the markets. SIP's have many benefits over lumpsum investm...

How to Identify the Right Fund Category?

The category of fund that is the most suitable for your requirements, is based on 2 key factors: - The Investment Horizon of your Financial Goals - Yo...

The Importance of Financial Planning

Financial Planning is very important from 2 Perspectives It allows you to gain an appreciation of your Actual Investment Horizon. This helps you ident...

IME PMS AMC Selection Criteria

At IME Capital, we have undertaken **the most rigorous analysis** of PMS AMCs, undertaken by any wealth management firm in the industry. Our PMS AMC s...

IME PMS Scheme Rating & Selection Criteria

At IME Capital, we have undertaken **the most rigorous analysis** of PMS Schemes, undertaken by any wealth management firm in the industry. Our PMS sc...

Why do we not recommend a particular fund or MF category?

Our partnership with Fundzbazar allows you to invest in virtually any fund or fund category of your choice. However, our recommend set of funds compri...

The Value of Compounding

Compounding is one of the most important principles of wealth generation. ### It essentially describes the Exponential Growth of your Wealth as your a...

The 7 Main Benefits of Mutual Funds

### Mutual funds are amongst the most popular investment options, due to the numerous benefits they offer investors. In this blog post, we discuss the...

IME Mutual Fund Selection Methodology

Our fund selection methodology is driven by the **fund-selection best-practices** followed by **top international institutional investor's and wealth...

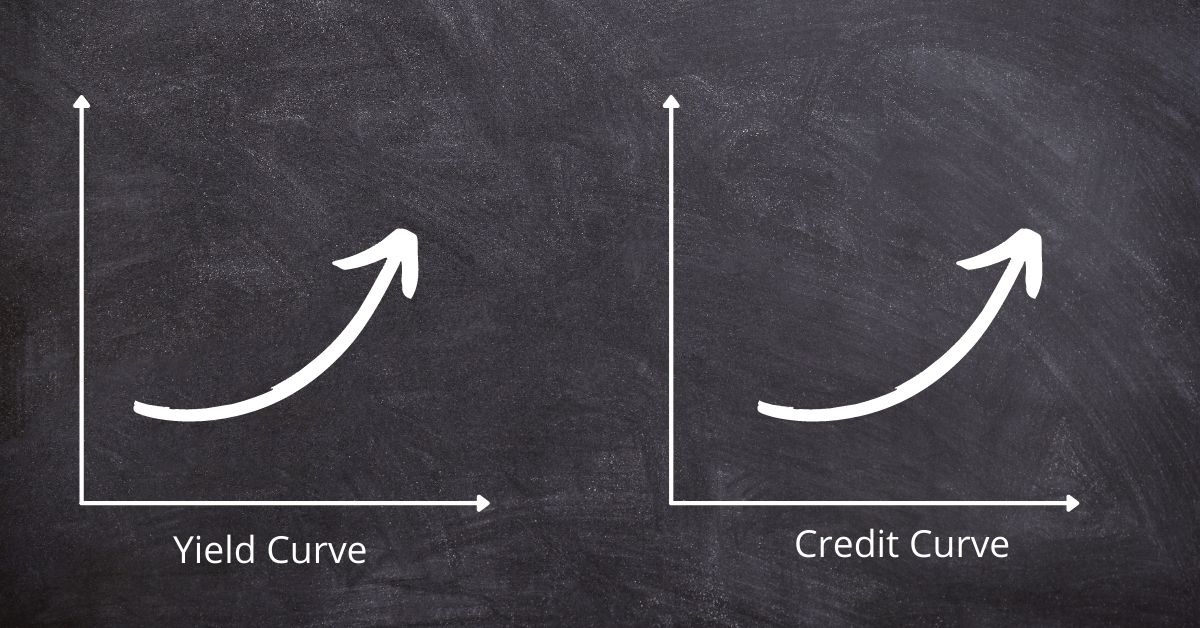

What Determines the Returns of a Debt MF?

There are 2 main factors the determine the returns earned by a Debt MF The yield (interest rate/coupon) of the securities held are the key determinant...

The Pros & Cons of Setting up A Trust for Your Investments

## Understanding the Trust Structure - **What is a trust?:** A trust is a legal structure by which a person (the settlor) transfers his assets to anot...

What is a Debt Mutual Fund?

Debt Mutual Funds are funds that invest in **fixed income securities** such as bonds, government securities, treasury bills and other money market sec...

Important Things to Keep in Mind While Writing a Will

## Quick Will Checklist - All essential personal details included (yourself, beneficaries, executioner & witnesses) - Register the Will (Recommended)...

What is Equity

Equity represents a proportionate ownership in a company's business. When you buy equity shares of a company, you own a certain part of that business,...

Why Risk in Equity depends on your Investment Horizon

Investor's misunderstand equity risk Most investor's don't truly understand equity risk. This is explained below. - High-risk High-return - Risk reduc...

A Typical Market Cycle

Equity markets are cyclical, with periods of weak market returns (i.e. bear markets) followed by periods of strong market returns (i.e. bull markets)....

What are Hybrid Funds & why they are Relevant?

Equity funds invest in equity stocks and generate higher returns, but with a higher level of risk. Debt funds on the other hand invest in debt securit...