How to Identify the Right Fund Category?

The category of fund that is the most suitable for your requirements, is based on 2 key factors:

-

The Investment Horizon of your Financial Goals

-

Your Risk Profile

In this post, we provide you with certain benchmarks of what are the most recommended fund categories, based on these 2 factors.

The Investment Horizon of Your Financial Goals

The investment horizon of your investment, is a very important consideration while selecting a fund category. One of the main reasons for this, is the way equity risk reduces over time. This is explained in greater detail in our Blog Post - Why Risk in Equity depends on your Investment Horizon. Essentially, equity is

Highly Risky in short-term (1-3 years)

Very high volatility in returns and high risks of losing money.

Mid Risk in medium-term (3-7 years)

Both volatility and chances of losing money reduce substantially

Almost risk-free in long-term (>7 years)

Very sharp reduction in volatility and very low chances of losing money

Financial goals can be of different types, and with different investment horizons. They can be short-term goals (such as a piggybank fund, a travel fund, a contingency fund), medium-term goals (the purchase of a house, funding of a dream vacation) and longer-term goals (planning for your child's education, retirement planning).

The appropriate fund category would differ across these different investment horizons. We provide below, what are considered to be the most suitable fund category across each major investment horizon.

Less than 1 yr

Low Duration Debt Funds

-

Low Interest-Rate or Credit Risk

-

No Exit-Loads

-

Good Alternative to Bank Savings & Current Accounts

1-3 Years

Short Duration Debt Funds

-

Low Interest-Rate or Credit-Risk

-

Higher Yields than Low-Duration Funds

-

Good Alternative to Bank Fixed Deposits

3-7 Years

Hybrid Funds

-

Mix of Debt & Equity

-

Good Balance between Growth & Stability

-

Sub-category based on Individual Risk-Profile

> 7 Years

Equity Funds

-

Low Risk-High Return in Long-Term

-

Best Risk-Reward across Asset Classes

Your Risk Profile

The other consideration while choosing the right fund category, is your risk profile.

While the core recommended asset class, should still ideally be driven by the investment horizon, your risk-profile can help determine the sub-asset class to choose amongst the various options.

Conservative

-Short-Term: Very low-risk Debt funds (ultra, low & short duration)

-

Medium-term: Conservative Hybrid Funds (conservative hybrid, equity savings scheme)

-

Long-term: Large-cap Funds

Moderate

-

Short-Term: Low-risk Debt funds (ultra, low & short duration. Corporate Bond and Banking & PSU also can be considered)

-

Medium-term: Balanced Hybrid Funds (equity savings scheme, dynamic and aggressive hybrid)

-

Long-term: Large & Mid-cap, Multi-cap & Flexi-cap Funds

Aggressive

-

Short-Term: HIgher-risk Debt funds (mix of duration based on interest rate view, credit risk)

-

Medium-term: Aggressive Hybrid Funds (equity savings scheme, dynamic and aggressive hybrid) or even Equity Funds can be considered

-

Long-term: Mid-cap, Small-cap or Sectoral Funds

It is important to understand, that these are Standard Benchmarks. Ultimately, the right category needs to be based on your Unique Requirements & Underlying Market Conditions.

To get a better understanding of what is the most suitable category for your specific requirements, feel free to get in touch with one of our specialists by using our WhatsApp Live Chat button below.

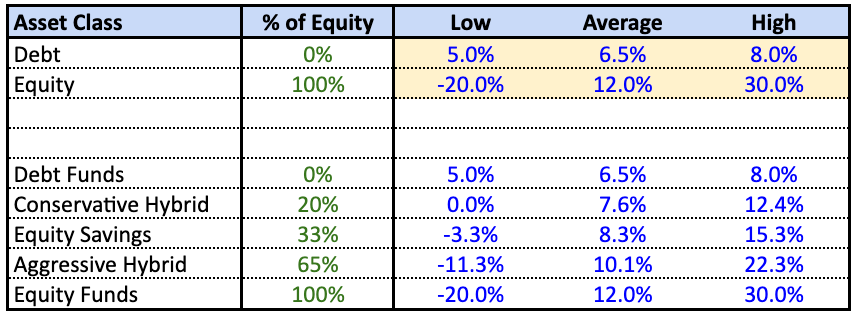

Indicative Risk-Return Payoffs of Core Asset Classes

The table below provides a broad indication of the risk-return across different asset classes, across weak, average and strong market conditions. Actual returns could vary in very strong or very weak market conditions.

Experience the benefits of working with a 'research-first' investments firm

Free 15-Day Trial of IME RMS App

Get complimentary access to the revolutionary IME RMS App (direct access to IME's central team insights across 1000's of MFs, PMSs, AIFs & Global funds - a first in the industry).

Additionally, a dedicated private banker will help build your financial plan, investment mandate & undertake a comprehensive portfolio review for free.