A Typical Market Cycle

Equity markets are cyclical, with periods of weak market returns (i.e. bear markets) followed by periods of strong market returns (i.e. bull markets). In this post we seek to explain:

-

What are the core factors the lead to bear & bull markets?

-

How bear markets turn into bull markets, and how bull markets lead to bear markets

-

How investor's react to bear & bull markets AND why normal investor behaviour is so detrimental to their interests

-

Why SIP's are so beneficial to help deal with market volatility

Bear Markets

Bear Markets

-

Weak Economic Growth

-

Weak Demand

-

Low Corporate Profitability

-

Weak Investor Sentiment

-

Low Valuations

-

Poor Equity Returns

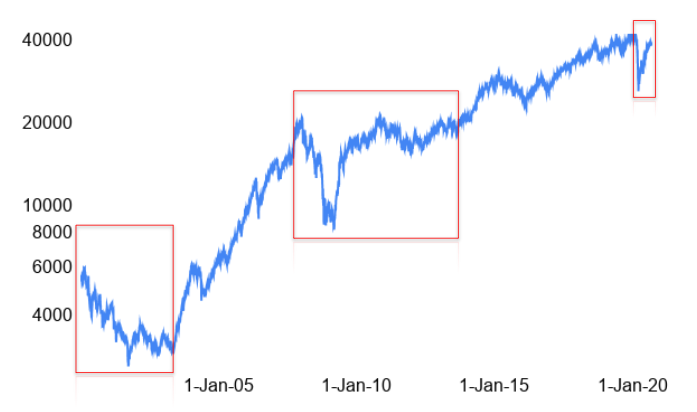

Bear markets typically follow a bull market (a period of strong economic growth, corporate profitability and strong market returns). There are various excesses that tend to get built up during bull markets (unsustainable economic growth, super-normal corporate profitability, weak governance practices and overtly optimistic market sentiment leading to high valuations).

Often, there is a particular event that takes place that exposes these excesses, leading to a sharp pull back in economic growth, corporate profitability and market sentiment.

As the economy slows down, demand for products & services reduces. This leads to a sharp reduction in corporate profitability (as both revenue & margins fall), which impacts market sentiments and valuations.

Loss of Investor Interest in Equities

Bear markets lead to a sharp reduction in investor interest in equities. Many investor's have taken large losses due to the market correction (and make a promise never to invest in equities again). Additionally, the poor outlook on economic growth & corporate profitability reduce the atractiveness of investing in equities.

Ironically, investor's stop investing in equities when it is the BEST TIME TO INVEST. Most stocks are available at a deep discount, and with both earnings & valuations being at lows, there is very little downside (and large potential upside) from a medium-to-long term perspective.

Bull Markets

Bull Markets

-

Strong Economic Growth

-

Strong Demand

-

High Corporate Profitability

-

Strong Investor Sentiment

-

High Valuations

-

Strong Equity Returns

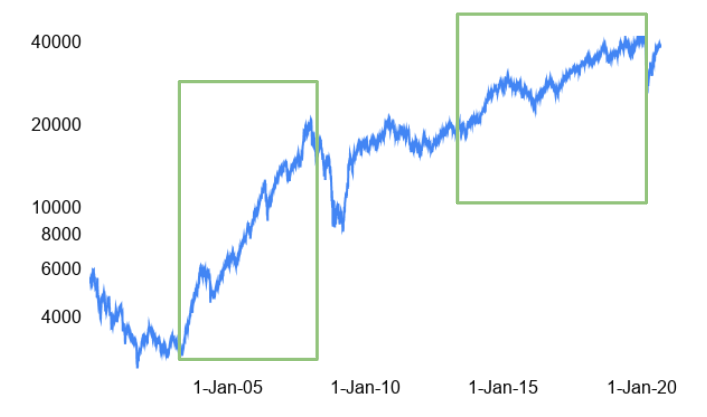

As the economy starts to pick up (it is important to understand that economic growth is cyclical), demand in the economy improves. Revenue growth for corporates start to increase, which is accompanied by an increase in margins (since fixed overheads are better absorbed on higher utilisations).

Saavy investor's start to take notice of the improved earnings outlook, and start increasing allocations to equities.

Increased Investor Interest in Equities

With every subsequent rise in the markets, more investor’s tend to get drawn into the markets, as they hear about the strong returns earned by their friends, family members and colleagues. As they too start to generate strong returns in their equity investments, confidence improves and equity allocations increase.

As equity continue to deliver strong returns, greed sets in, as equities are outperforming all other asset classes.

Most investor's end up investing the most in equity at what is probably the WORST TIME TO INVEST. Market valuations have turned expensive, corporate profitability has peaked and expectations of future growth are unrealistic.

The Return of the Bear

Suddenly, out of the blue, something happens and markets crash. It is sometimes an economic event that triggers a panic, a scam being revealed or sometimes simply just a sudden crash in market sentiment. The simple truth is that towards the end of a market cycle, valuations have lost ground with reality, most corporates have started to use creative accounting to keep pace with ever growing investor expectations and the economy is simply not as healthy as it is perceived to be.

Investor’s suddenly see their wealth vanish in a matter of a few weeks or month, and are stuck reeling with losses. They promise to be smarter the next time around, and to never get tempted by equities in the future. They stop their investments into equities in-line with a fall in the markets (at the time when the greatest long-term bargains are available in the market).

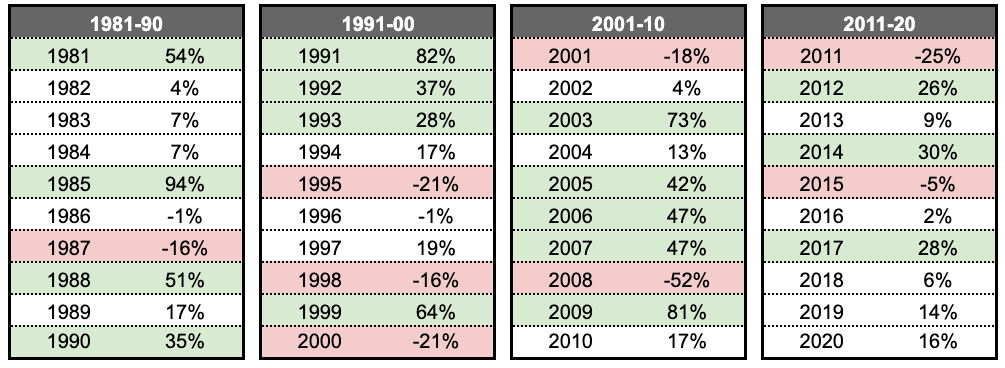

These cycle's happen again, again & again

For example, consider the last 40 years in the Indian markets. Every decade, has a bull market, a bear market and a period of average market returns.

The important point to realise is that bull & bear markets are an inherent part of equities. Instead of trying to time the markets you will do much better if you ignore market volatility and stay invested for the longer-term.

Investing for the longer-term, allows you to benefit from the inherent upward movement in equity due to economic growth that helps compound your wealth over time regardless of bull or bear markets.

The benefit of Systematic Investment Plans (SIPs)

Market movements in the short-medium term, are almost impossible to predict. Trying to take calls on the market, can lead to investors selling too early in a bull market or buying to early in a bear market. While it is easier to control your emotions over the short-term, this becomes increasingly difficult to control over the longer-term, as markets move contrary to your expectations.

Instead of trying to take market calls on when to make investments, we recommend that investor’s invest in equity via a systematic & disciplined investment approach, known as Systematic Investment Plans (SIPs). A SIP leads to an investor investing a stated sum of money every month, regardless of market conditions.

The benefits of SIPs include:

-

Inculcates discipline in investing

-

Takes advantage of power of inertia

-

Offers the benefit of rupee cost averaging

-

Benefits from higher volatility

-

Removes the dilemma of when is the right time to invest

The primary reason investors lose money in equity, is that they invest when markets are expensive and sell when markets are cheap. This issue is resolved, if investor’s invest via a SIP.

Experience the benefits of working with a 'research-first' investments firm

Free 15-Day Trial of IME RMS App

Get complimentary access to the revolutionary IME RMS App (direct access to IME's central team insights across 1000's of MFs, PMSs, AIFs & Global funds - a first in the industry).

Additionally, a dedicated private banker will help build your financial plan, investment mandate & undertake a comprehensive portfolio review for free.