Taxation Structure of Different Investment Structures

The capital gains tax regime can be complex, with different rates & threshold period for different asset classes & investment structures. We provide below a handy table, that helps explain the tax-rates across asset clases.

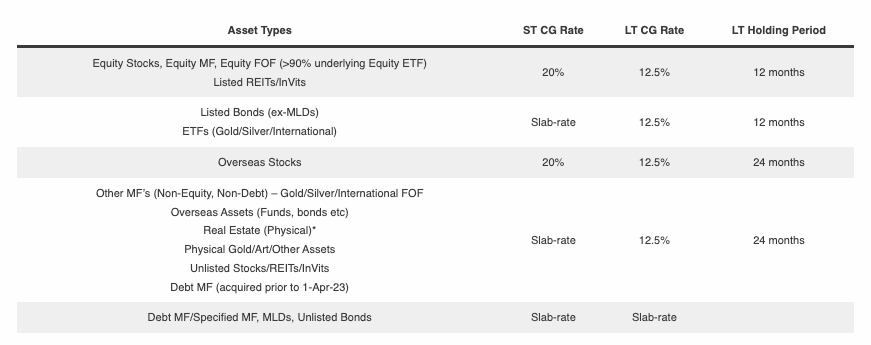

New Tax Structure (Post 23-Jul-24)

Note

-

Applicable for assets sold after 23-Jul-24

-

for real estate bought before 23/July/2024, the LTCG upon sale, one has 2 options -- a) no indexation benefit and taxed at 12.5% or b) indexation benefit and taxed at 20%

-

These rates are only for capital gains (income from other sources such as interest would be taxed at different rates)

-

Specified MF's include MF Schemes with >65% in SEBI regulated debt & Money Mkt instruments

-

Equity MF's include MF Schemes with >65% in Equity

-

LT Capital Gains on Equity Stocks & MF's are exempt up to Rs. 1.25 lakhs per year

Understanding the Construct behind the New Taxation System

-

Most debt (ex-listed bonds) has no LT taxation and taxed at slab rate: with Debt MFs, MLDs & Unlisted bonds considered debt in this case

-

Long-term Capital Gains (12.5%): for all (ex-above)

-

Short-term Capital Gains (20% vs Slab): Only for Equity & equity-like securities (listed REITs/InVits, Overseas Stocks) -- all others at slab rate

-

Long-term period definition: Listed in Recognised Indian Stock Exchange (12 months) / Unlisted Assets (24 months)

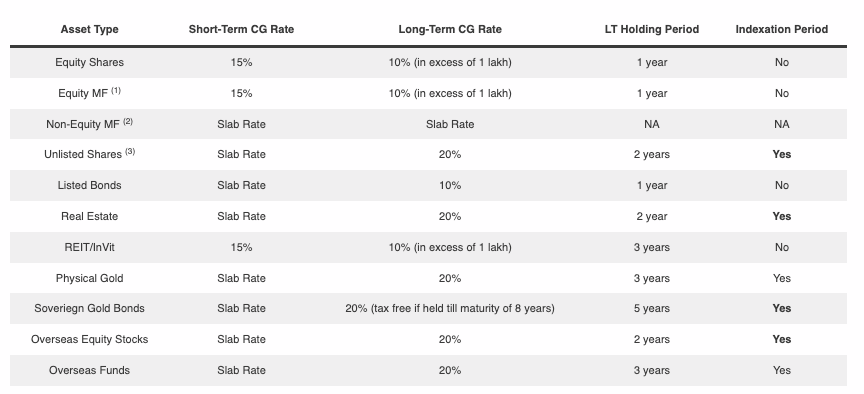

Earlier Tax Structure (Prior to 23-Jul-24)

Classifications

(1) Equity Mutual Funds: Includes pure equity funds, aggressive hybrid, equity savings & arbitrage funds (since arbitrage is considered equity from a tax perspective)

(2) Non-Equity Mutual Funds: include all Mutual funds with less than 35% of investment in Indian Equities (i.e. Debt funds, conservative hybrid funds, international feeder funds, Gold Funds etc) | ETFs (International, Gold etc) are also considered non-Equity MF's from a taxation perspective

(3) Direct International via International Brokers: taxed similar to Unlisted Shares

Setting-off for Capital Losses

-

Long-term Capital Losses, can only be set of against Long-Term Capital Gains.

-

Short-term Capital Losses, can be set of against Short-term & Long-Term Capital Gains.

-

Capital losses can be carry-forwarded for 8 years, from the assessment year in which the loss was computed.

Experience the benefits of working with a 'research-first' investments firm

Free 15-Day Trial of IME RMS App

Get complimentary access to the revolutionary IME RMS App (direct access to IME's central team insights across 1000's of MFs, PMSs, AIFs & Global funds - a first in the industry).

Additionally, a dedicated private banker will help build your financial plan, investment mandate & undertake a comprehensive portfolio review for free.