Lumpsum versus Staggering? What is the more optimal way to invest larger sums of money?

Investors sometimes have a larger-than normal amount of money that is available for investments (this could be due to an annual bonus, an asset sale, inheritance or other such events). We are often asked the question on whether it is better to invest this money in one-shot as a lumpsum investment, or would it be better to stagger the investments over a period of time?

Against conventional wisdom, staggering your investments typically leads to a more expensive entry point into the markets

As with all matters related to investments, answers to questions are often more nuanced as compared to simplistic answers that are often given to investors.

Since equity markets are volatile, investors are often recommended to stagger their investments, since this allows them to average down the cost of their investments in case markets were to correct during the period of staggering. However, the flip side of this argument is also true - if markets were to continue to move up over the period of your staggering, this would lead to a higher average cost of your investments.

Since structurally markets are on an uptrend, and markets tend to move up more than they move down, on average you will be better off investing in one-go as compared to spreading your investments over a period of time.

Since structurally markets are on an uptrend, and markets tend to move up more than they move down, on average you will be better off investing in one-go as compared to spreading your investments over a period of time.

It is only in situations where markets see a large correction in the short-term after the investor makes an investment, where staggering leads to an overall lower cost. Investors should accordingly weigh the likelihood of a sharp market correction, along with the fact that on average it works out cheaper to invest lumpsum, in order to take a decision on a lumpsum vs a staggered investment approach.

What does the past data indicate in terms of lumpsum vs staggering?

In order to better understand the pros & cons of lumpsum vs staggered investing, we have undertaken a study using the past 20 years of Sensex data, where we compare the average investment cost across this period of investing in a lumpsum versus investing in a 12-month staggered fashion.

Lumpsum investing leads to lower/cheaper entry points in most cases

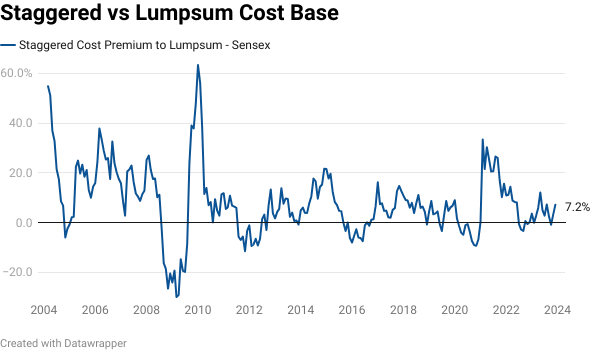

- Over the past 20 years, on average it would cost an investor 7.2% more to invest in a staggered fashion, as compared to lumpsum investing.

- Additionally, in 75%+ of the months studied, lumpsum investing would have lead to a lower overall entry point as compared to investing in a staggered manner.

The results of this study can also be seen in the graph below, which shows on a month wise basis how much more expensive a staggered investment approach has been compared to a lumpsum investment.

Sharp market corrections shortly after investments are the main risk

Over the past 20 years, the only months in which a staggered investment approach would have left to a lower cost of holding, have been in months just immediately prior to a major fall in the markets.

- The subprime crisis was the best example, where a 12-month staggered investment approach would have lead to a 20% lower investment cost

- Apart from the sub-prime crisis, the only other periods where a staggered investment approach would have proven cheaper include 2012 (taper tantrum), 2016 (extended time correction), 2020 (covid). Interesting in each of these cases, a staggered approach would have only lead to an average cost what would be ~5% lower than that of a lumpsum approach

There is no 1 right-answer!

Lumpsum investing is likely to lead to a lower cost of investments. However, staggering helps reduce the risk of seeing a sharp drop in the value of your investments, very shortly after investing.

Often investors may be more concerned with protecting short-term downside, as compared to the fear of investing at slightly higher market levels. In these cases as well, staggering may be a better approach.

Another way of looking at it, is that if there appears to be chances of a large correction in the near-term it may be better to stagger your investments. However, if there is no forseeable risks to the markets in the shorter-term, a lumpsum investment may be the better approach.

Over the long-term, specific timing very rarely matters

Investments in equities are typically only recommended for a 5-7 year investment horizon (or often even longer). On average, the difference in average cost of lumpsum vs staggering very rarely is more than 5% - which often is less than a 1% difference in terms of longer-term returns. Investors need to focus more on the value of the longer-term compounding potential of equities, as compared to trying to time the entry into markets in the shorter-term.

Experience the benefits of working with a 'research-first' investments firm

Free 15-Day Trial of IME RMS App

Get complimentary access to the revolutionary IME RMS App (direct access to IME's central team insights across 1000's of MFs, PMSs, AIFs & Global funds - a first in the industry).

Additionally, a dedicated private banker will help build your financial plan, investment mandate & undertake a comprehensive portfolio review for free.