The Importance of an Investment Mandate

What is an investment mandate?

Your investment mandate is a written document, that clearly spells out your unique requirements, that includes your

Risk-Profile

An assessment of your risk-taking ability & your risk-appetite.

Financial Goals

Visibility into your core goals & actual investment horizons

Investment Beliefs/Preferences

Helping identify the types of investments you are most comfortable with

Other Requirements

Liquidity/concentration limits, asset allocation preferences, etc.

Your investment mandate serves as your strategic roadmap that defines how you would like your investment to be managed.

Most investors operate with either weak or no investment mandates

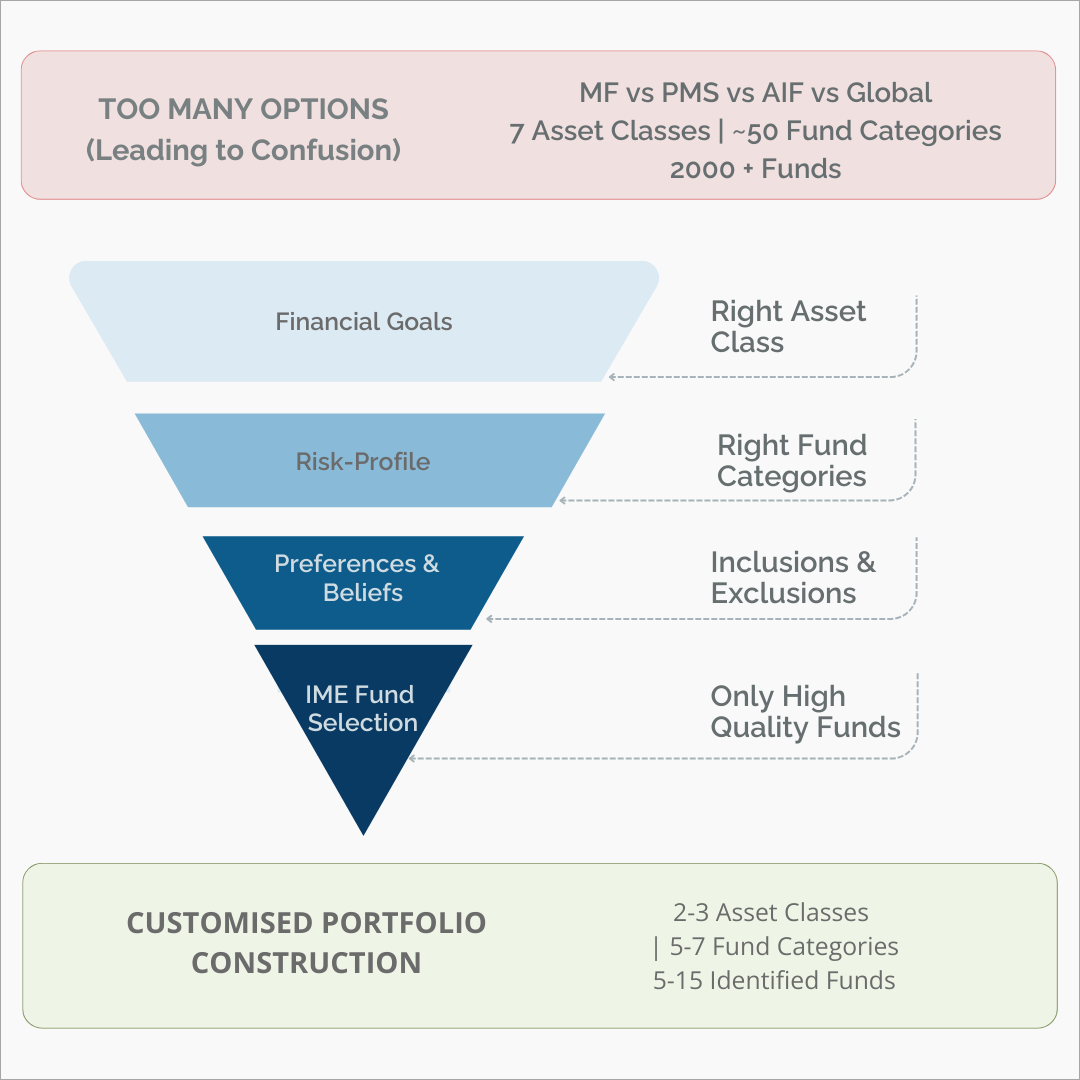

This leads to investments being made in an ad-hoc manner, often based on what is appearing the most attractive at a specific point in time. Wealth managers often stop at a risk-profile and financial goals while defining a mandate, leaving out very important factors such as your unique investment beliefs, preferences and best-fit categories for investments.

The Benefits of an Investment Mandate

Portfolios tailor-made to your unique requirements

A deep understanding of your risk-profile, financial goals, investment beliefs & preferences and other such requirements, helps ensure that your investment portfolio is truly customised to meet your own unique requirements.

A clear road-map for your investments & more strategic investments

Your investment mandate provides a clear roadmap defined to understand what investments are the most suited for your requirements and helps ensure that your longer-term portfolio is built out accordingly. This helps you move away from transactional to strategic investments.

A clear understanding of your investment options & their relevance in your portfolio

The process of building out a mandate helps you gain a much clearer understanding of the larger investment universe, with the pros & cons of different options, to help identify what are the most suited fund categories for your defined requirements.

The Impact of a Weak or No Investment Mandate

Transactional investing

Most investors without a clearly defined mandate, tend to hop around between different fund categories based on whats trending at that specific point in time. Often, fund categories that are most in favor have run their course, and may be the worst categories to be investing in at that specific time.

Investing outside your unique requirements

There are always certain specific fund categories that are the best fit for a specific investor (based on their risk-profile, financial goals and investment beliefs & preferences). Without identifying the fund categories that are the 'best-fit' for your unique requirements, you can often end up investing in categories that do not work for you, often leading to sub-optimal investment returns.

Sub-optimal investing

Investing without first having understood the larger investment universe, and the pros & cons of various options, can often lead to your investing in sub-optimal fund categories when there may have been better options available.

About IME's Investment Mandate

At IME Capital, our investment mandate development process is a lot more exhaustive than the standard risk-profiling & financial goals common with other wealth management firms. Our investment mandate process is a detailed one-on-one consultation, that helps us identify your unique requirements.

While this includes the standard risk-profiling & financial goals, our mandate process goes deeper into understanding your specific investment beliefs & preferences, to identify what investment categories serve as the best-fit for you.

These best-fit categories, along with any other requirements that you define, are available online on our interactive client portal. This helps ensure complete consistency between you and your relationship manager, and provide a clear roadmap for future discussions around investment recommendations & portfolio reviews.

Interested in developing a Strategic Roadmap for your investments based on your unique requirements.

Book a free consultation with our specialists.

Experience the benefits of working with a 'research-first' investments firm

Free 15-Day Trial of IME RMS App

Get complimentary access to the revolutionary IME RMS App (direct access to IME's central team insights across 1000's of MFs, PMSs, AIFs & Global funds - a first in the industry).

Additionally, a dedicated private banker will help build your financial plan, investment mandate & undertake a comprehensive portfolio review for free.