What Determines the Returns of a Debt MF?

There are 2 main factors the determine the returns earned by a Debt MF

Yield

The yield (interest rate/coupon) of the securities held are the key determinant of the return potential of the debt fund. There are 2 main factors that impact yields:

• Maturity: debt with a higher maturity typically offer a higher yield, but this is accompanied with a higher interest-rate risk

• Credit-risk: debt issued by lower-rated corporates offer a higher yield, but this is accompanied with a higher credit-risk

Change in Interest Rates

• If market interest rates go down, existing bonds (offering a higher coupon) become more valuable, leading to CAPITAL GAINS.

• If market interest rates go up, existing bonds (offering a lower coupon) lose some value, leading to CAPITAL LOSSES.

• Debt funds are thus subject to interest-rate risk, that is determined by the maturity of their holdings.

In this post, we examine these factors in greater depth.

Yield (YTM) of the Holdings

The YTM (Yield-to-Maturity) of a Debt Fund, is basically the weighted average yield of the underlying securities held by the fund.

From a bond market perspective, there are 2 important curves that represent the premium that bonds of a higher maturity or a lower credit rating offer investors. These are the:

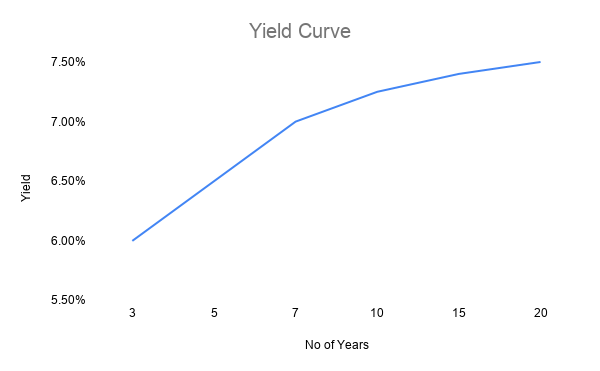

Yield Curve

-

As the maturity of the debt security increases, investor's desire a higher interest rate to compensate for lending money for a longer-time. This is represented by the yield curve.

-

This is similar to bank FDs, where you typically earn a higher interest rate for longer maturity deposits.

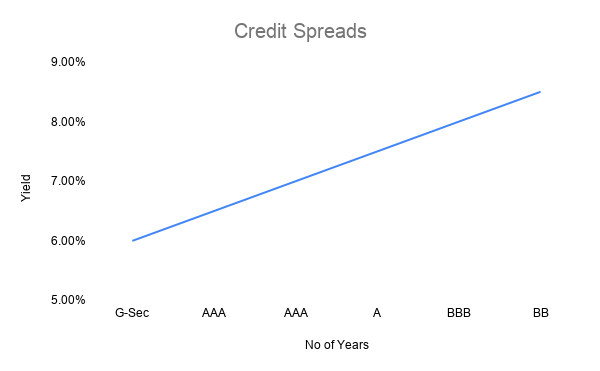

Credit Spreads Curve

• Investor's would demand a higher interest rate to lend to a riskier borrower. This is represented in the credit spread curve.

• This is similar to bank FDs, where you would desire a higher interest rate for a fixed deposit from a smaller less-known bank.

Debt funds that invest in longer-maturity bonds or bonds with a lower credit-quality will offer a Higher Yield (YTM).

This is however accompanied with higher interest-rate OR credit-default risk.

This is why it is important to be very selective on your choice of debt funds, to choose a fund that meets your risk-appetite.

Changes in Market Interest Rates

Interest rates in the economy are constantly changing. Since the coupon (or interest rate) on a bond is fixed, any change in market interest rates has an impact on the market value of bonds.

The market value of a bond is inversely related to the change in interest rates.

Interest rates fall

Interest rates rise

The market value of a bond is inversely related to a change in interest rates

Longer-maturity bonds have higher interest rate sensitivity than short-duration bonds.

In case this seems a bit complicated

• Debt MF's offer varying levels of risk, based on their mandate

• There are funds that only invest in low-duration papers (low interest rate risk) & high-quality papers (low credit risk)

• By investing only in lower-risk funds, you can enjoy the many benefits that debt MFs have over bank FDs with minimal incremental risk

Experience the benefits of working with a 'research-first' investments firm

Free 15-Day Trial of IME RMS App

Get complimentary access to the revolutionary IME RMS App (direct access to IME's central team insights across 1000's of MFs, PMSs, AIFs & Global funds - a first in the industry).

Additionally, a dedicated private banker will help build your financial plan, investment mandate & undertake a comprehensive portfolio review for free.