PMS & AIF Taxation

Overview

PMS Taxation

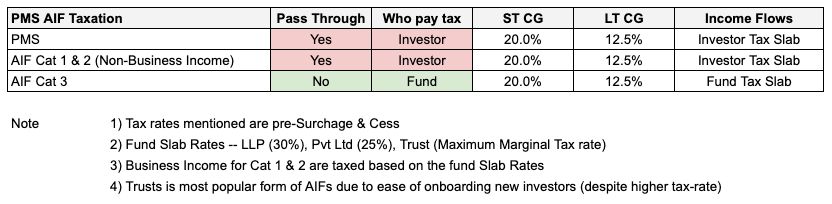

PMS is a pass-through vehicle from a tax perspective.

Since under a PMS, investments are held directly in the investor's name (and not via a trust like in a MF or AIF), the tax liability for the PMS investor is the same as the investor directly buying or selling shares/securities in his own name.

Accordingly, the taxation of PMS investments are as follows:

-

Equity Capital Gains: 20% (ST - less than 1 year holding) / 12.5% (LT - greater than 1 year holding with a 1.25 lakh exemption)

-

Other Forms of Capital Gains: will be taxed based on the nature of the gains, please refer to this blog

-

Equity Dividend Income: added to income tax slab

-

Interest Income: added to income tax slab

AIF Taxation

Taxation of AIF's are based on 2 factors:

-

AIF Classification

-

Fund Legal Structure

AIF Classification

Alternate Investment Funds (AIFs) are categorized as follows:

-

Category I (CAT 1): Funds that invest in start-up or early-stage ventures. This extends to social ventures or SMEs or infrastructure or other sectors or areas which the government or regulators consider as socially or economically desirable.

-

Category II (CAT 2): Funds that do not fall under CAT 1 and CAT 3, do not undertake leverage or borrowing.

-

Category III (CAT 3): Funds that employ diverse trading strategies. They use leverage through listed and unlisted derivatives and buy stocks or other allowed assets.

Fund Legal Structure

SEBI regulations permit an AIF to be set up in the form of a trust, a company, a limited liability partnership, or a body corporate.

Category I & Category II: These categories are granted a special pass-through status (except for business income). The pass-through status for non-business income applies regardless of whether the AIF is set up as a Trust, Company, or LLP.

Category III: Category III AIFs do not have the statutory pass-through status granted to Category I & II AIFs. The applicable tax rates depend on the legal structure of the AIF and the nature of the income.

Experience the benefits of working with a 'research-first' investments firm

Free 15-Day Trial of IME RMS App

Get complimentary access to the revolutionary IME RMS App (direct access to IME's central team insights across 1000's of MFs, PMSs, AIFs & Global funds - a first in the industry).

Additionally, a dedicated private banker will help build your financial plan, investment mandate & undertake a comprehensive portfolio review for free.