Why Risk in Equity depends on your Investment Horizon

Most investor's don't truly understand equity risk. This is explained below.

General Understanding

- High-risk High-return

- Risk reduces in longer-term

- Risky Asset Class

Reality

- Ease of Operations

- Systematic Investments

- Tax Efficient

The reality is that equities are:

Highly Risky in ST (1-3 yrs)

Very high volatility in returns and high risks of losing money.

Mid Risk in MT (3-7 yrs)

Both volatility and chances of losing money reduce substantially

Very Low Risk in LT (>7 years)

Very sharp reduction in volatility and very low chances of losing money

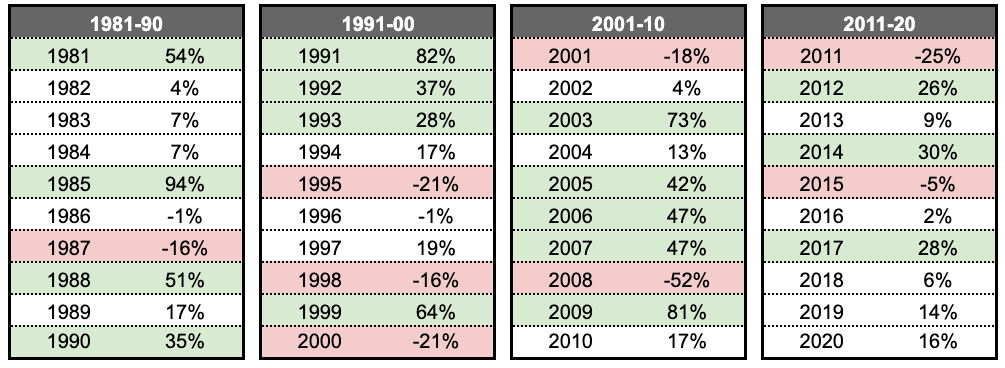

Equity returns are not-linear

Economic growth & equity markets are cyclical. There are good years and bad years.

If you look at any 10-year period over the past 4 decades, you will see that each decade has a mix of very good years, average years and bad years.

When you invest for the long-term, the good and bad years average each other out.

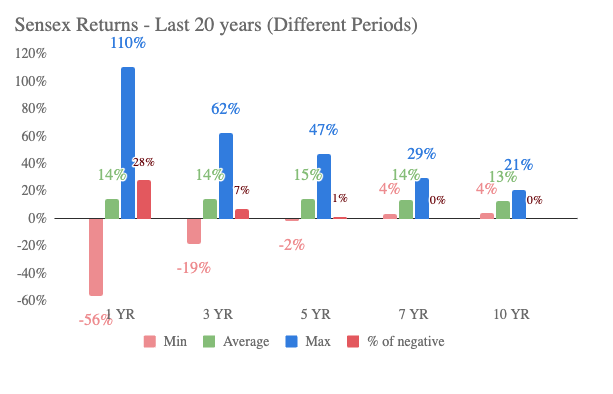

Equity returns over different time-periods

To understand equity returns better, it is useful to study how equity returns vary across time-periods over the past 20 years (Jan 20 - Jul 20).

This 20-year period is a good representation comprising periods of strong bull markets & sharp market corrections. This includes:

Strong Periods

Weak Periods

In the short-term, your returns are very dependent on if you have invested in a strong or weak-period.

Over the long-term, your returns average out the good & bad years leading to high-returns with much lower risk & volatility.

This can be seen clearly in the chart below, that shows how much the difference between min, average & max returns reduces with time.

Assuming an investor could invest on the 1st trading day of any month, we analyzed how his investment returns would have varied depending on his investment holding period (1 year, 3 year, 5 year, 7 year and 10 year).

As the data shows, equities can be highly risky over the short-term (less than 3 years).

While risk clearly reduces over the medium-term (3-7 years), what really stands out is how much risk reduces over the long-term (7 years).

For investor's who held equity for 7 years of more, not only did they never lose money regardless of when they invested, but in over 95% of the time they earned well-above what they would have earned in any other asset class.

Experience the benefits of working with a 'research-first' investments firm

Free 15-Day Trial of IME RMS App

Get complimentary access to the revolutionary IME RMS App (direct access to IME's central team insights across 1000's of MFs, PMSs, AIFs & Global funds - a first in the industry).

Additionally, a dedicated private banker will help build your financial plan, investment mandate & undertake a comprehensive portfolio review for free.