The Value of Compounding

Compounding is one of the most important principles of wealth generation.

It essentially describes the Exponential Growth of your Wealth as your allow your investments to continue to grow over a period of time (without redemptions).

The reason that compounding is so powerful, is that by remaining invested, you begin to earn returns on the returns that you have generated in earlier periods. This allows for an exponential increase in the value of the money that you have invested.

There are 2 key factors to consider, that help you make the most use of the power of compounding

-

Investment Horizon: The longer the period for which you can remain invested, the greater will be the exponential growth in your wealth. This is why starting to invest early is so important from a wealth creation perspective.

-

Rate of Return: The higher the rate of return on your investments, the greater the power of compounding. This is why investing in higher return asset classes like equity, are so strongly recommended for LT wealth creation.

A simple example of the power of compounding

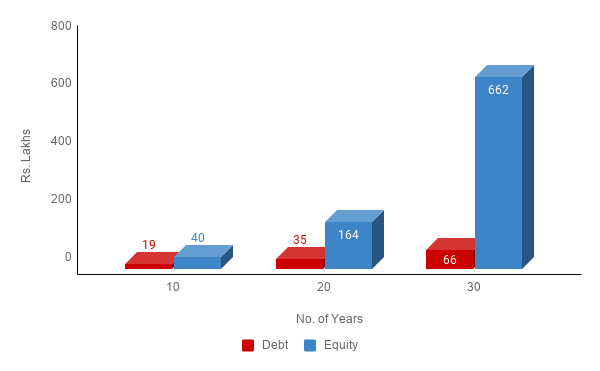

The power of compounding can be best understood by a simple example. Let us consider you have Rs. 10 lakhs to invest.

You could choose to invest your money in a low-risk low-return asset class like debt (assume a 6.5% interest rate) or in a higher-risk higher-return asset class like equity (assume a 15% rate of return).

The chart below is a graphical representation of the future value of the Rs. 10 lakhs that you have invested across debt or equity, and across different time horizons.

As would be expected, you would make more by investing in equity. However, what is important is the substantial difference in the extent to which your wealth compounds over longer periods of time.

-

Over a 10-year period, you are over 2x more wealthy

-

Over a 20-year period, you are over 5x more wealthy

-

Over a 30-year period, you are over 10x more wealthy

Experience the benefits of working with a 'research-first' investments firm

Free 15-Day Trial of IME RMS App

Get complimentary access to the revolutionary IME RMS App (direct access to IME's central team insights across 1000's of MFs, PMSs, AIFs & Global funds - a first in the industry).

Additionally, a dedicated private banker will help build your financial plan, investment mandate & undertake a comprehensive portfolio review for free.